Revised Economic Assessment Will Be Completed in Q2 2013

WEST PERTH, AUSTRALIA -- (Marketwire) -- 03/06/13 -- Peak Resources Limited ("Peak" or "the Company") (ASX: PEK) (OTCQX: PKRLY) today announced further improvements to beneficiation processes for the Ngualla Rare Earth Project in Tanzania. The ability to concentrate mineralisation at an early stage prior to acid leach recovery will have a significant and positive impact on costs and support Peak's target to be a low cost producer.

Highlights:

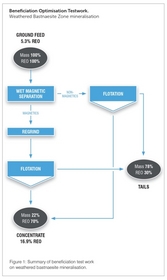

Figure 1: Summary of beneficiation test work on weathered bastnaesite mineralisation

- The optimisation of the beneficiation process effectively reduces the mass of feed to be treated by the acid leach recovery process by 43% compared to the scoping study assumptions. This will lead to significantly lower capital and operating costs for the operation.

- The latest test work shows that conventional magnetic separation and flotation techniques reduces the mass of the feed mineralisation by 78% through the rejection of relatively unmineralised barite and iron oxides.

- Reducing the amount of material processed at the acid leach recovery stage has a significant impact on operating costs by reducing sulphuric acid consumption -- the major constituent of reagent costs. The scoping study completed in early December 2012 estimated that the acid plant and acid leach recovery circuit make up 53% of total operating costs.

- The reduction in volume treated will also reduce capital costs as a smaller plant will be required for the same amount of product. The acid leach recovery circuit and the acid plant together constitute 27% of total project capital costs as estimated in the scoping study.

- The beneficiation process increases the grade of the feed over 3 fold from 5.3% REO* to 16.9% REO for this composite sample.

*REO=total rare earth oxide

The cost reductions will be quantified in a revision of the scoping study and economic assessment to be completed in Q2 2013. The revised study will also use a new optimised mine schedule based on the new Mineral Resource estimate and model that is on schedule for completion by the end of March 2013.

Peak Managing Director Richard Beazley said, "Ngualla continues to improve with each milestone. We are already in the lower quartile in terms of operating costs, and also have one of the lowest capital costs of any rare earth project. This new test work will allow us to reduce costs even further and supports our assertion that Ngualla is the most commercially attractive rare earth project around."

Technical Report:

The metallurgical processing route in the December 2012 scoping study (see ASX Announcement of 3rd December 2012 'Scoping Study') included a beneficiation circuit that provided a 53% mass rejection for 86% rare earth recovery and an upgrade of feed material from 5.3% to 9.7% REO.

Further optimisation of the beneficiation process has now been completed at Nagrom laboratories in Perth, Western Australia under the direction of IMO consultants. Refining the wet magnetic separation and flotation process (Figure 1) has improved the scoping study figures to 78% mass rejection for 70% rare earth recovery and an upgrade of feed material from 5.3% to 16.9% REO.

The improved beneficiation process effectively reduces the mass of feed material into the acid leach recovery plant by 43% compared to the scoping study for the same rare earth content.

All the above test work was completed on the same sample of weathered bastnaesite mineralisation, a representative composite sample from diamond hole NDD007.

Financial Implications

The scoping study defines robust economics for the Ngualla Rare Earth Project, highlights being:

NPV US$1.571 billion

IRR 53%

Annual revenues US$361 million

Payback < 3 years

Contributing to these figures are already low operating costs of U$10.09/kg REO product and capital costs of US$400 million excluding contingency for the baseline case production level of 10,000 tonnes of rare earth oxide per year.

The acid leach plant and leach recovery circuit contribute 53% to total operating costs, with sulphuric acid being the major reagent cost. The 43% reduction in feed mass to acid leach recovery due to the improved beneficiation is expected to reduce sulphuric acid use by a similar proportion.

Likewise, the sulphuric acid and acid leach recovery plants, which constitute 27% of total capital costs, are expected to be significantly reduced in size.

The improved beneficiation parameters, together with the new Mineral Resource model due for completion before the end of March 2013, are significant enough to warrant a revision of the scoping study and economic assessment.

A revised economic assessment for Ngualla will be completed in Q2 2013.

Appendix:

Table 1: Classification of Mineral Resources for the Ngualla Rare Earth Project, 1.0% and 3.0% REO cut-off grades (February 2012).

-------------------------------------------------------------

JORC

Lower cut - off Resource REO Contained

grade Category Tonnage (Mt) (%)* REO tonnes

-------------------------------------------------------------

1.0% REO Measured 29 2.61 750,000

---------------------------------------------

Indicated 69 2.43 1,700,000

---------------------------------------------

Inferred 72 1.92 1,400,000

---------------------------------------------

Total 170 2.24 3,800,000

-------------------------------------------------------------

3.0% REO Measured 11 3.99 430,000

---------------------------------------------

Indicated 21 4.09 850,000

---------------------------------------------

Inferred 8.7 4.11 360,000

---------------------------------------------

Total 40 4.07 1,600,000

-------------------------------------------------------------

*REO (%) includes all the lanthanide elements plus yttrium oxides. Figures above may not sum precisely due to rounding. The number of significant figures does not imply an added level of precision.

Table 2 - Relative components of individual rare earth element oxides (including yttrium) as a percentage of total REO for the Ngualla Mineral Resource Model ( > 1% REO).

--------------------------------------------------

Oxide % of Total REO*

----------------------------------------------------------------------

Light Rare Earths Lanthanum La2O3 27.1

--------------------------------------------------

Cerium CeO2 48.3

--------------------------------------------------

Praseodymium Pr6O11 4.74

--------------------------------------------------

? Neodymium Nd2O3 16.3

--------------------------------------------------

Samarium Sm2O3 1.65

----------------------------------------------------------------------

Heavy Rare Earths ? Europium Eu2O3 0.35

--------------------------------------------------

Gadolinium Gd2O3 0.78

--------------------------------------------------

? Terbium Tb4O7 0.07

--------------------------------------------------

? Dysprosium Dy2O3 0.17

--------------------------------------------------

Holmium Ho2O3 0.02

--------------------------------------------------

Erbium Er2O3 0.06

--------------------------------------------------

Thulium Tm2O3 0.00

--------------------------------------------------

Ytterbium Yb2O3 0.02

--------------------------------------------------

Lutetium Lu2O3 0.00

----------------------------------------------------------------------

Other ? Yttrium Y2O3 0.52

--------------------------------------------------

Total % 100

----------------------------------------------------------------------

(*= Mineral Resource block model 2012 at 1% REO cut)

The blue markers denote the five "critical rare earths," which are predicted to be in undersupply in the years ahead and predicted to command significantly higher value than other rare earths. (US DoE, 'Critical Materials Strategy' report, December 2011).

The critical rare earths contribute the majority of the value from Ngualla at 56% of the in ground value. Of these, neodymium is the main single rare earth value driver, contributing 34%, (relative rare earth oxide prices: Metal Pages, 11th September 2012).

About Peak Resources

Peak is developing the Ngualla Project, a potentially low-cost, long term rare earth project located in south west Tanzania. Ngualla has been ranked as the fifth largest deposit in the world outside China, and the highest grade of the top seven.

Ngualla has a Mineral Resource of 170 million tons grading 2.24% of rare earth oxides (REO). Within the resource there is a highly weathered and near-surface zone estimated at 40 million tons at 4.07% REO, equivalent to 1.6 million tons of contained REO (see Table 1 below for resource classifications). Ngualla is also a bulk deposit which is largely outcropping. These attributes place the project among the world's most notable rare earth discoveries of recent years.

Ngualla is a potential low cost open pit mine due to its shallow outcropping high grade mineralization. The initial sighter metallurgical test work to date has been completed using a sulphuric acid leach process route suggesting a relatively less complex, potentially cheaper capital outlay and shorter time to production.

Safe Harbor Statement

The Company does not intend, and does not assume any obligation, to update these forward-looking statements and information. The information in this report that relates to Exploration Results is based on information compiled and/or reviewed by Dave Hammond who is a Member of The Australasian Institute of Mining and Metallurgy. Dave Hammond is the Technical Director of the Company. He has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves." Dave Hammond consents to the inclusion in the report of the matters based on his information in the form and context in which it appears. Certain statements contained in this document constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward looking information under the provisions of securities laws. When used in this document, the words "anticipate," "expect," "estimate," "forecast," "will," "planned," and similar expressions are intended to identify forward-looking statements or information.

Such statements include without limitation: statements regarding timing and amounts of capital expenditures and other assumptions; estimates of future reserves, resources, mineral production, optimization efforts and sales; estimates of mine life; estimates of future internal rates of return, mining costs, cash costs, minesite costs and other expenses; estimates of future capital expenditures and other cash needs, and expectations as to the funding thereof; statements and information as to the projected development of certain ore deposits, including estimates of exploration, development and production and other capital costs, and estimates of the timing of such exploration, development and production or decisions with respect to such exploration, development and production; estimates of reserves and resources, and statements and information regarding anticipated future exploration; the anticipated timing of events with respect to the Company's minesites and statements and information regarding the sufficiency of the Company's cash resources. Such statements and information reflect the Company's views as at the date of this document and are subject to certain risks, uncertainties and assumptions, and undue reliance should not be placed on such statements and information. Many factors, known and unknown could cause the actual results to be materially different from those expressed or implied by such forward looking statements and information. Such risks include, but are not limited to: the volatility of prices of gold and other metals; uncertainty of mineral reserves, mineral resources, mineral grades and mineral recovery estimates; uncertainty of future production, capital expenditures, and other costs; currency fluctuations; financing of additional capital requirements; cost of exploration and development programs; mining risks; community protests; risks associated with foreign operations; governmental and environmental regulation; the volatility of the Company's stock price; and risks associated with the Company's by-product metal derivative strategies. For a more detailed discussion of such risks and other factors that may affect the Company's ability to achieve the expectations set forth in the forward-looking statements contained in this document, see the Company's Annual Report on Form 20-F for the year ended December 31, 2011, as well as the Company's other filings with the Australian Securities Administrators and the U.S. Securities and Exchange Commission.

Image Available: http://www2.marketwire.com/mw/frame_mw?attachid=2249861

Add to DiggBookmark with del.icio.usAdd to Newsvine

Contact:

Peak Resources Limited

Richard Beazley

Managing Director

Phone: +61-8-9200-5360

Email: richard@peakresources.com.au

MZ Group - North America

Derek Gradwell

SVP

Natural Resources

Phone: 949-259-4995

Email: dgradwell@mzgroup.us

Web: www.mzgroup.us